Monthly Minimum Wage

- Starting from January 1, 2025, Mexico’s minimum wage has been adjusted and increased by 12% due to inflation. The daily wage has been raised from 248.93 Mexican pesos to 278.80 Mexican pesos. In the northern border free – trade zone, the minimum wage has been increased from 374.89 Mexican pesos to 419.88 Mexican pesos.

- Christmas bonus: Employees with at least one year of service are entitled to 15 days of full pay, while employees with less than one year of service will receive an amount proportional to their length of service.

Overtime Pay and Maximum Working Hours

- Overtime pay is mandatory. Working hours beyond the maximum working hours are considered overtime, and there is no upper limit on weekly overtime hours. Employees will be compensated for additional working hours. The standard working hours are 8 hours per day, up to 48 hours per week. If the weekly working hours are 40 hours, the standard working days are from Monday to Friday. Extended working hours are 48 hours from Monday to Saturday.

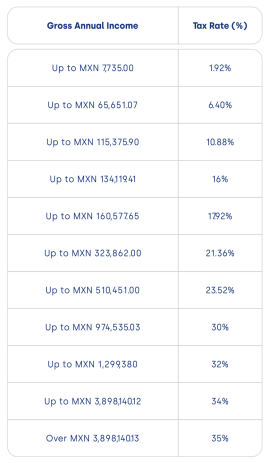

Personal Income Tax

- The personal income tax rate ranges from 1.92% to 35%. Income tax is calculated on a progressive basis.

Statutory Holidays

The corresponding relationship between years of service and vacation time is as follows:

| Years of Service | Vacation Time |

|---|---|

| 1 year | 12 days |

| 2 years | 14 days |

| 3 years | 16 days |

| 4 years | 18 days |

| 5 years | 20 days |

| Every 5 years (after 5 years) | 2 additional days |

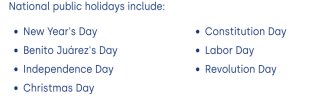

National Holidays

- Mexico celebrates seven national holidays and one local holiday.

Other Holidays

- Maternity Leave: Pregnant employees are entitled to 84 days of paid leave. The leave must start 40 days before the child’s birth and cannot be interrupted. During this period, employees will receive 100% of their average salary, which will be paid by the Mexican Social Security Institute (IMSS). Employees can also apply for rest within six months after giving birth, that is, the lactation period. Employees can extend the leave, but it will be unpaid.

- Paternity Leave: Employees are entitled to five days of paid paternity leave. Employees will receive 100% of their average salary during this period, which will be paid by the employer.

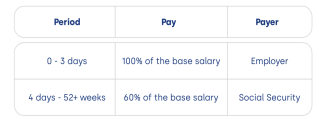

- Paid Sick Leave: Employees are entitled to up to 52 weeks of paid sick leave, and the Mexican Social Security Institute may grant additional weeks. Depending on the type of illness, the leave time will be paid at different rates by different payers.

Employment Contracts

- The contract must be in Spanish and can be bilingual, written and signed by both parties.

Probationary Period

30 – 180 days

Employer Costs

- Social Security lMSS – MXN 643.71

- LocalTax – 3.00% (The situation varies slightly in each state, ranging from 3 – 4%. Different enterprises enjoy different tax incentives. Please verify carefully.)

- Surplus Fee(extra social security cost for special salaries) 1.10%

- Occupational risk – 0.50% (This is only in the case of the lowest risk. We need to carefully review the company’s situation and the employee’s risk factor.)

- Retirement and old age – 4.241%

- Retirement – 2.0%

- Benefit for disabilities – 0.70%

- Disablement and Life Insurance – 1.75%

- Nursery and Social Benefits – 1.0%

- Medical Expenses – 1.05%

- Infonavit(mortgage fund) – 5.0%

Termination of Employment (Legal Requirements and Best Practices)

- Notice Period: There is no notice period in Mexico.

- Voluntary Resignation: No compensation is required. Employees are allowed to resign at any time by providing a signed letter of resignation, but the employer needs to settle the unused benefits with the employee.

- Termination during Probationary Period: Either employer is allowed to terminate the employment of an employee at any time during the probationary period on the grounds that the employee is not suitable for the position (in general, compensation may be involved). Both parties need to sign a termination agreement when terminating an employee during the probationary period.

- Negotiated Termination: Both the employer and the employee are allowed to agree to terminate the employment relationship for any reason, and severance pay is required. It must be paid in case of termination without cause. The severance pay is three months’ salary, plus 20 days’ salary for each year of service, and a seniority allowance of 12 days’ salary per year. (An item for unsettled allowances needs to be added here.)

- Termination for Cause: The reason for termination must be proven beyond doubt and indisputably. The employer must provide the employee with a written document (called Acta Administrativa) describing the behavior leading to termination and the date of occurrence. The employee must admit the misconduct and sign the document to accept the termination. If the employee refuses to sign the document, the employer must initiate legal proceedings through the court. Failure to prove a legal reason for termination is considered unfair dismissal, which may result in civil litigation and large – scale compensation for the employer.

发表回复